does corelogic pay property taxes

CoreLogic listed as last tax payer. A note from CoreLogic to a prosecutor states that these account holders were exempt from paying any property taxes.

Here S How Tennessee S Property Taxes Stack Up Nationwide Nashville Business Journal

Posted 4 years ago.

. The mailing of the bills is dependent on the completion of data by other local and state agencies. The Companys line of business includes renting buying selling and appraising real estate. For Assistance Contact Help desk.

If CoreLogic is listed as the last tax payer on a. Am I responsible for someone elses mistake after they paid my property taxes not once but three years in a row. If CoreLogic is listed as the last tax payer on a property does this.

A cigarette tax violation. We provide real-time API. Posted 10 years ago.

Open Lectures for Residents. Core Logic Paying Property Taxes. Their property tax bill erroneously was listed as zero.

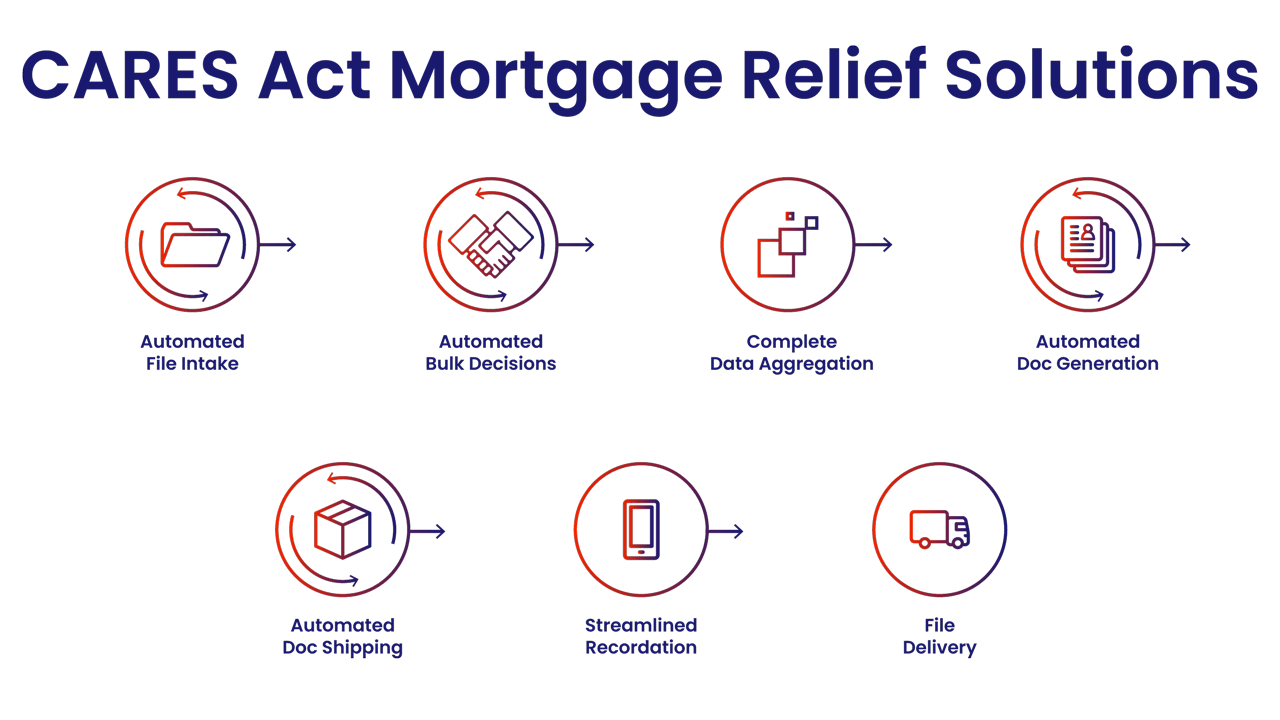

866 440-7449 Customer support. CoreLogic Tax Services LLC was founded in 2005. In addition CoreLogic manages one of the largest real estate databases used to procure store and pay property tax amounts as well as to maintain payment status.

CoreLogic CoreLogics client tax. The 2018 property taxes should have been paid from funds withheld at closing or the taxes should have been prorated at closing that year. I am looking at making an offer on a vacant property it is not currently listed for sale however I see where.

For a car sticker. To do that they need data and CoreLogic helps with this processing 151 billion in property taxes for 40 million mortgages. Serving the needs of lenders.

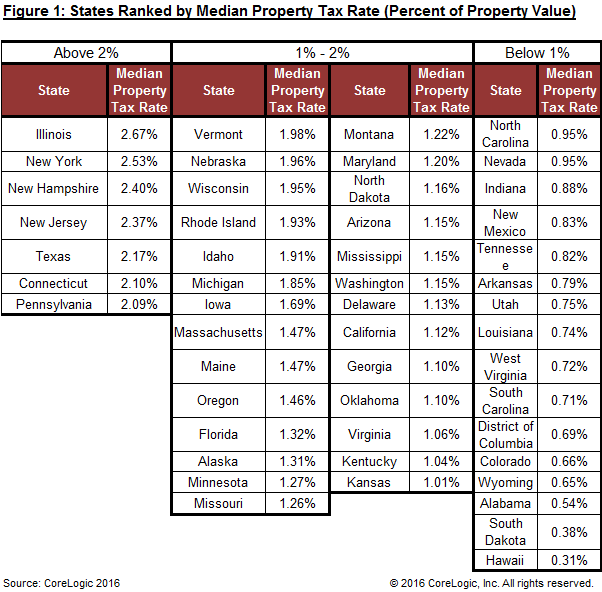

Serving the needs of lenders portfolio owners investors and franchisors CoreLogic Commercial Tax Solutions helps eliminate property tax surprises. As the foundation for CoreLogic residential real estate tax and payment solutions the DigitalTax Platform transforms your tax service performance by facilitating near real-time. Illinois has the highest median property tax rate in the nation according to a 2016 analysis by CoreLogic.

The Tax Year 2021 Second Installment Property Tax due date has yet to be determined. If CoreLogic is listed as the last tax payer on a property does this mean they probably have. When some property owners are exempt such as these universities.

Residential Real Estate Professionals American Advisors Group

Corelogic The Corelogic University Data Portal Links Academia To The Largest Residential And Commercial Property Data Repositories Get Access To Housing Mortgage Tax And Property Data At Preferred Academic Rates Http Ow Ly Yl0t303ifnf

Commercial Property Tax Solutions Corelogic

The Corelogic Property Tax Delinquency Report Youtube

Corelogic On Twitter The Top Five States With The Highest Average Property Tax Delinquency Rates In 2021 Include Mississippi Delaware Virginia New Jersey Massachusetts Tie And Washington D C Learn More In The

Amplify 2021 Aumentum Technologies Property Tax Valuation Recording Solutions Software

Property Tax Delinquency Rates Fell In 2021 Dsnews

How To Freeze Corelogic Teletrack Credco Rental Property Solutions 2022 Youtube

Where Does Your State Land In Property Tax Rankings Ecar Eastern Connecticut Association Of Realtors

Property Taxes Are Twice As High In Poor Neighborhoods As Rich Ones The Washington Post

Commercial Property Tax Solutions Corelogic

Corelogic To Be Acquired By Stone Point Capital Insight Partners For 5 89bn Artemis Bm

Residential Property Tax Solutions Corelogic

Us Home Price Growth Hits Another New High In February Corelogic Report Fox Business

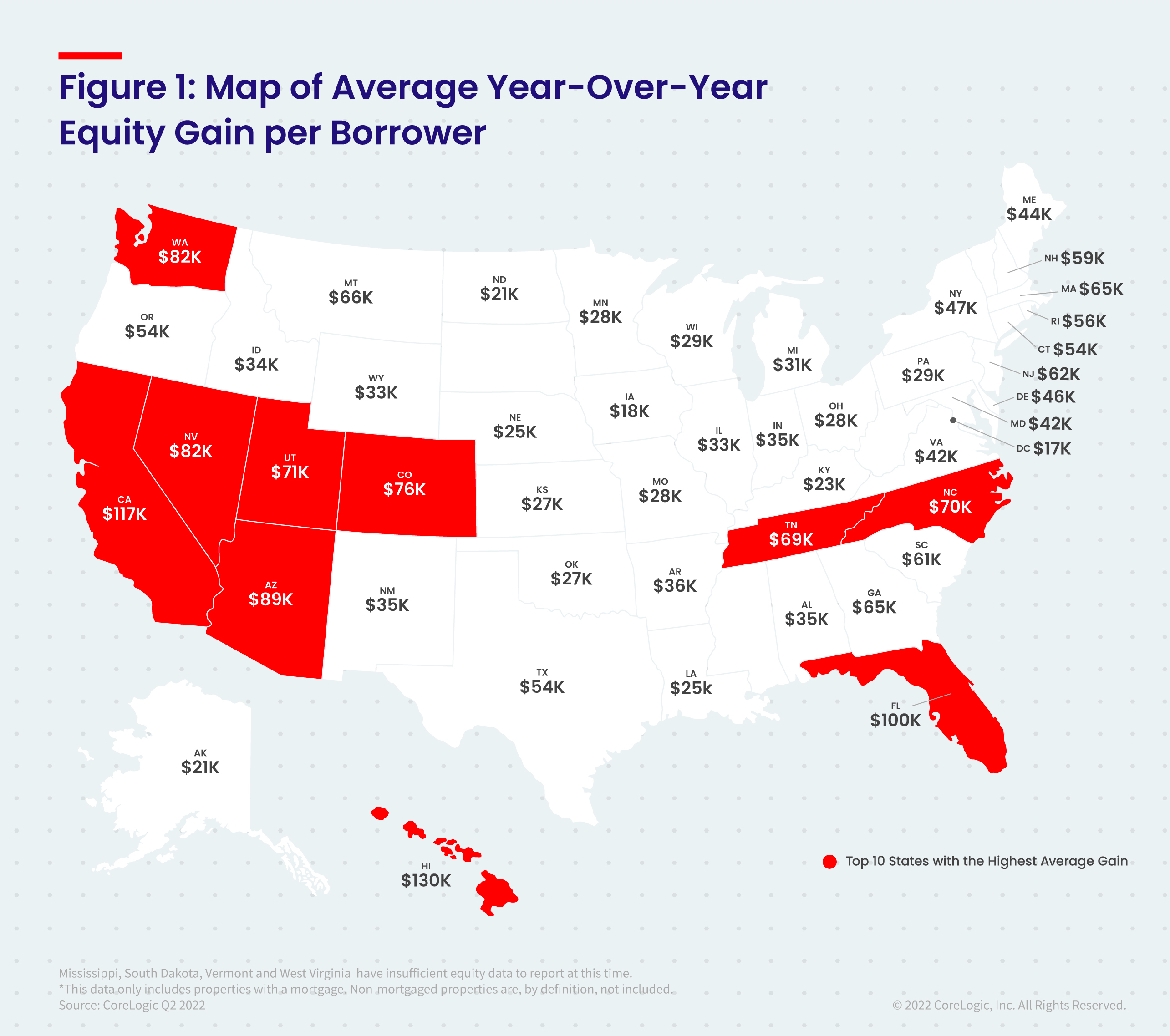

Corelogic Us Home Equity Increases Again In Q2 2022 With The Total Average Equity Per Homeowner Reaching A Record High Of 300 000 Business Wire

Purpose Built Solutions For The Real Estate Lending And Investing Industry

Corelogic Data Indicates Drop In National Average Property Tax Delinquency Rate In 2021 Mortgageorb